When you’re starting a new business, you will need to determine the business structure that’s best for you. Structuring your company correctly is vital when building the foundation of your business.

After completing Step 3 of the Startup Roadmap and you’re feeling great about your research, strategy, and plan, it’ll be time to register your business.

How will you determine the best option for your business? Let’s review the different business types and consider how each may impact liability and taxes for your business.

The Different Business Structures

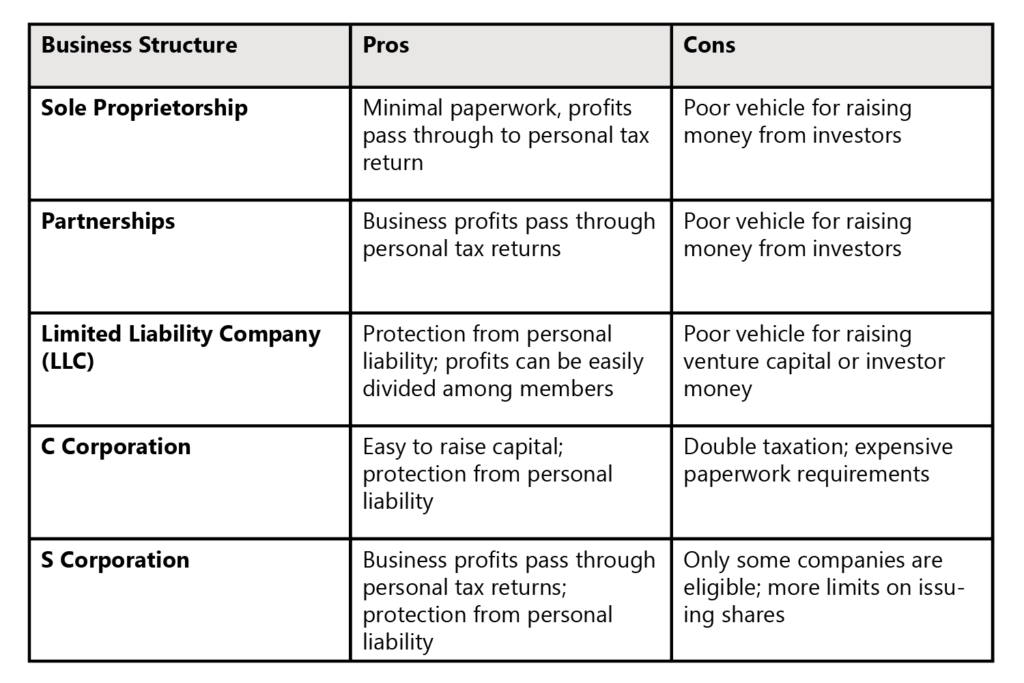

Sole Proprietorship

This is the most common setup for a single business owner. It requires little or no paperwork, it’s easy to form and offers the owner full control of the business. The business assets and liabilities are not separate from your personal assets and liabilities meaning you can be held personally liable for the debts and obligations of the business. The profits of the business pass through to the owner’s personal tax return and are taxed at the personal tax rate.

Partnerships

A partnership is similar to a sole proprietorship but involves two or more people who agree to own a business. The partners divide the profits or losses of the business and report it on their personal tax return. Each partner is personally liable for the financial obligations of the business.

Limited Liability Corporation (LLC)

A limited liability company is a hybrid business structure that provides personal liability protection to its owners, who are known as members. Owners’ personal assets — such as your vehicle, house, and savings accounts — won’t be at risk in case your company faces bankruptcy or lawsuits. An LLC is more flexible than a corporation by the way it is managed and taxed, and by the way profits and losses can be allocated among its members.

Profits and losses can get passed through to your personal income without facing corporate taxes. However, members of an LLC are considered self-employed and must pay self-employment tax contributions towards Medicare and Social Security.

C-Corp

A C corporation is a legal entity that is separate from its owners. Corporations can make a profit, get taxed, and are held legally liable. They offer the strongest protection to its owners from personal liability, but the cost to form a corporation is higher than other structures. Corporations also require more extensive record-keeping, operational processes, and reporting. Corporate profits are taxed twice — first when the company makes a profit, and again when dividends are paid to shareholders on their personal tax returns.

S-Corp

An S corporation is a special type of corporation that’s designed to avoid double taxation like in a C-corp. The business itself is not taxed but the shareholders are, provided that they are paid “fair market value”. Shareholders have limited liability so their personal assets are protected. Businesses with fewer than 100 shareholders can be organized as an S Corporation.

What to consider when choosing your business structure

Legal Liability

What’s your liability as a business owner?

No matter what type of business you have, you’ll have to consider the potential risks from lawsuits.

For example, Selling an ebook through a website has a very different level of risk compared to a dropshipping company that sells baby products which it doesn’t personally make.

Do you plan on hiring employees or contractors?

If you hire someone and they make a mistake that results in damages, can you afford the cost of their mistake?

- Operating as a sole proprietorship or general partnership, your personal assets are at risk if you lose a lawsuit or go bankrupt and owe a debt.

- An LLC and Corporation will separate your personal assets and your business. These structures will provide protection for your personal assets in the event of a lawsuit.

Taxation

How do you want your business profits to be taxed?

Benjamin Franklin said there were only two things certain in life: death and taxes; however, the amount of taxes you pay will vary drastically depending on the business structure you decide!

For example, sole proprietorships, partnerships, and S corporations are pass-through entities, as are some LLCs. As a pass-through entity, profits are passed directly to the owners of the business. Come tax time, it is reported on the owners’ individual returns at their personal tax rate!

Whereas a C-Corp is not as tax-friendly since it’s subjected to double taxation. First, when the company makes a profit, and again when dividends are paid out to the shareholders.

It’s important to note that:

– Sole proprietorships, partnerships, and LLCs must pay a self-employment tax.

– C-Corps are also taxed at the corporate tax rate.

When an LLC decides to be taxed as an S-Corp, it allows the owner to give himself a reasonable salary from the business income and treat the remaining income as unearned distributions. Distributions are not subject to the self-employment tax, so this will lower your tax bill.

Bottom Line

Each structure has its advantages and disadvantages, so consider how each will impact the many factors of your business such as liability and taxes.

It’s possible to switch your business structure plan later, but it’s best to understand your business’s plans and goals for the future BEFORE you structure because otherwise, it will be very complicated and costly to change structures.

We encourage all startups to follow the Startup Roadmap. If you’ve completed the first 3 steps before structuring, it will be a much easier and clearer decision for you and your company to make.

Need more help deciding what’s best for you? Schedule a free call with an Aha To Exit advisor and we’ll help you further explore the options that are available to you.