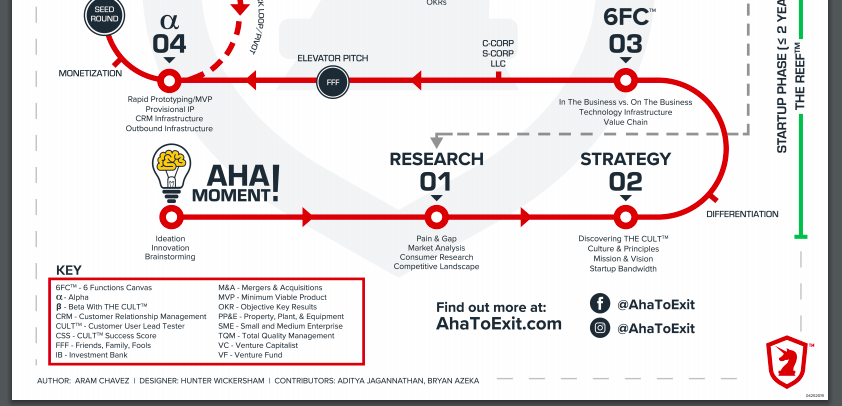

The Modern Business Plan = Foundational Intellectual Property Portfolio

Why FIPP?

It may be a mouthful to say, but your Foundational Intellectual Property Portfolio (or FIPP) will give you the confidence to walk into all of your future investor meetings and do the following:

1. Provide a pre-revenue valuation.

A pre-revenue valuation is so hard to capture. (Don’t worry, we’ve created a system to help you). It is important to have this so you can tell your investors that your startup is worth a certain amount of money and why they should invest your desired amount to get a specific return.

2. Answer their questions with expert knowledge.

Here are some sample questions your potential investor will ask you and you should answer them during your pitch deck and be fully prepared to answer after:

- Why would I invest in your company?

- When will I get my money back?

- How much money do you need?

- What will you do with the money?

- What do I get in return when I invest?

- Will I be added to your team of advisers?

- How involved will I be in the company?

- What are your COGS & How will you reduce them?

- What is your top-line revenue?

- How do you plan to expand and make more money?

3. Negotiate their offer

Prepare for investors to try to find the best deal… for them! This is a business, and it can often be hard to distinguish a great offer from a sleazy one. When you’re a young venture, without years of negotiating experience, it can feel very daunting when dealing with an investor or investment firm. After all, this is your baby, and you don’t want to give any more equity than you should (fair!)

How do you stay strong in negotiation to protect your equity, but not lose out on an investment that will surely help you grow?

With The Reef Cloud Accelerator, you’ll be fully prepared for the negotiation table and equipped with actual strategies written by experienced VCs and Angels.

How To Build Your FIPP:

It can be a little time consuming and scary, but you already have the guided roadmap to complete it (if you don’t, get your Startup Roadmap here).

“Investors don’t have time to read your 80-page business plan, and you don’t have time to write one!” – Aram Chavez, founder of Aha To Exit

What’s Included with your FIPP

- Pain & Gap Graph

- Understanding if your product fills a pain in the marketplace, a gap, or both.

- Market Research Landscape

- With this, you will be able to understand the market that you are entering inside and out.

- Competitor Landscape

- After completing this, you will be able to identify your competitors and where your venture lands within the sea of competition.

- Consumer Persona Sheets

- You may have many customer personas, but you want to identify their psychographics, demographics, and behavioristics. This will enable you to understand your customers, empathize with them, and build offers customized to each of your customer segments. Lastly, you’ll be able to use this when you get to step 7 and start guerrilla marketing.

- The C.U.L.T

- Customer, User, Lead Tester; these are your first and most important customers. You need to identify them and know how to utilize them to guide your venture in the right direction.

- Culture & Principles Deck

- Write these down, know them by heart, and all of the decisions for your company moving forward will lead you to where you want to be.

- Mission & Vision Deck

- Transparency with your customers is key. Your mission and vision decks will share this.

- FFF Outbound Strategy Document

- Friends, family and fools – will among the first to provide funding for your company. This will help you reach out to them for maximum investment.

- Startup Bandwidth Canvas

- Understanding the bandwidth available within your startup is vital for scaling properly.

- Six Functions of a Business Canvas™

- There are six core functions of a business. However-two of them MUST have more time and resources dedicated to them than the others and it’s critical that you have the correct perspective within your organizational structure.

- In The Business vs. On The Business

- Working on the business is not the same as working in the business. Learn to understand the difference between the two, and when to do each.

- Tech Infrastructure Canvas

- There are technologies that can assist with virtually every part of your venture, and it can definitely be overwhelming. We can help you focus on what’s important.

- Value Chain Canvas

- Know every process that exists within your business, how it works, and how it contributes to the success of your venture.

- Funding Pitch Deck

- Learn how to properly pitch your venture’s story, purpose, and needs to investors to maximize the use of your time with investors.

- MVP Validated Learning Testing document

- Produce an actual prototype of your product/service, and get rapid feedback you need to tailor it exactly to your customers’ needs.

- Provisional IP Document

- Learn what is needed to legally protect your hard-earned intellectual property, and what type of intellectual property is appropriate for various parts of your venture.

- CRM Infrastructure Document

- Customer Relationship Management (CRM) is critical for keeping your existing and future customers organized and happy. Learn what it takes to use a CRM system effectively.

- Outbound Infrastructure Document

- Discover how to build and leverage a thriving community of loyal customers who will become your brand evangelists, advocates, and sources of feedback.

During the process of building your FIPP, you may discover loopholes or opportunities you were unaware of before starting the process. This may even lead to a pivot in your venture. You’ll want to make sure all options are exhausted before moving forward with your startup.

If you’ve completed your FIPP and moved through variations of your venture before you approach an investor, you’ll be in a much better position to negotiate and get what you deserve!